|

Mercury Retrograde vs DJIA

Does the Mercury retrograde have an effect on the stock market? Multiple studies say "Yes".

Here are the studies

|

|

Space Weather vs DJIA

Space weather distrubances have a Bearish affect on the Stock Market.

Here are the daily results for first half of 2021

|

|

Trading The Weather

Yes, the weather does affect the Stock Market.

Good Day Sunshine: Stock Returns and the Weather by David Hirshleifer and Tyler Shumway. 2001

|

| |

Click Here

|

|

Lunar cycle effects in stock returns

Study by the University of Michigan Business School.

|

| |

Click Here

|

|

Stock Commodities & Planetary Declination

Observations by W.D Gann, George Bayer, Larry Pesavento.

How Mercury affects the price of Microsoft.

|

| |

Click Here

|

|

Cycle Back-testing

Back-testing for: IWM, NDX, GC, MSFT, XOM, XLB using different stop levels.

|

| |

Cycle-Back-Test.xlsx

|

|

Rediscovering WD Gann

|

| |

Rediscovering W. D. Gann�s method of forecasting the financial markets

|

|

Gummy Financial Excel Workbooks |

| |

Lots and lots of financial workbooks here. View

list

|

|

Solar Activity and Short Term Market Moves |

| |

Playing the Field: Geomagnetic Storms and the Stock Market

-- by The Federal Reserve Bank of Atlanta

View Study

|

|

Don't Make These Mistakes! |

| |

Knowing what to buy and when is important, but this

is what causes most traders to lose.

Overconfidence,

and Common Stock Investment

The

Trading Behavior of Individual Investors

|

|

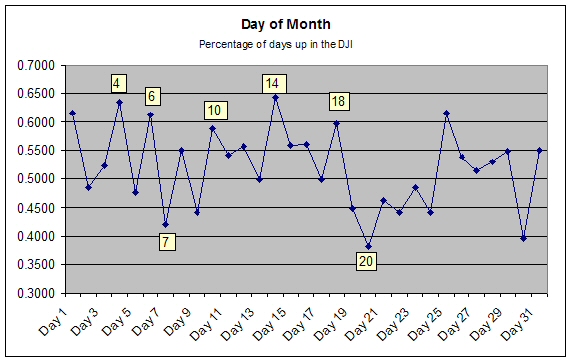

DJI behavor by day of the month |

| |

The 4th, 6th, 10th, 14th and 18th are usually positive

The 7th and 20th are usually negative. Not enough data

for the 30th.

|

|

Free Sample of the OSS INDICATORS Newsletter |

| |

OSS_INDICATORS_110124.pdf

|

|

How the market behaves when Mars Trine Jupiter |

| |

Mars_Trine_Jupiter_2000_to_2010.pdf

|

|

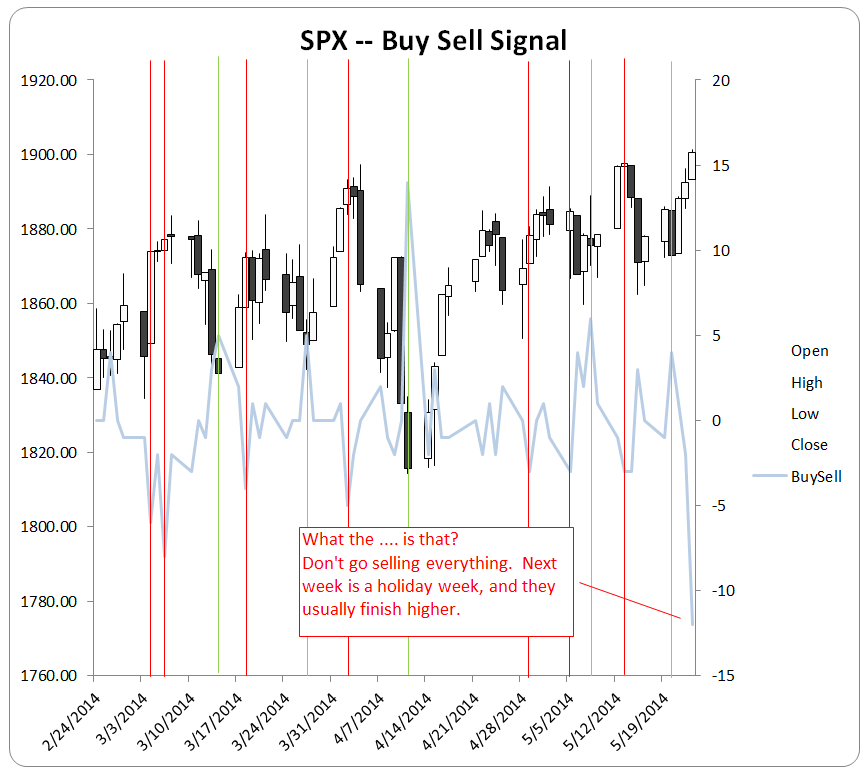

OSS Buy/Sell Indicator as a market timing tool.

Published nightly for subscribers to the OPTION SIGNAL SERVICE and the OSS INDICATORS newsletter.

|

| |

|

| |

|