Trading the 1/3 Method

Actually shorting a stock or other financial instruments can be a bit difficult to wrap your head around, and you better have plenty of money in case thing go against you. For those who wish to keep things simpler, and trade the ups and downs in cryptos while at the same time HODLing, there is the Law of Three.

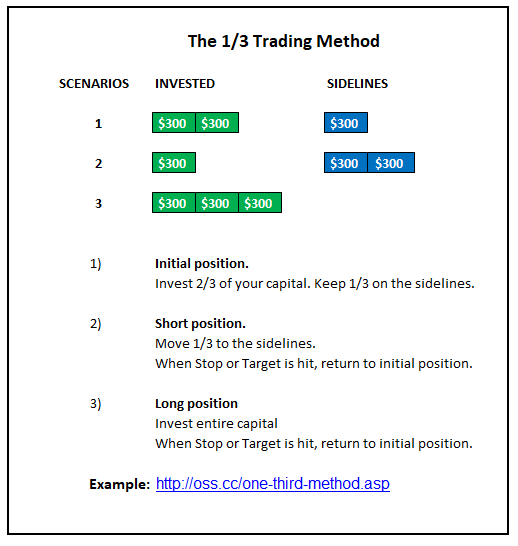

Let's say you want to buy $900 of Litecoin (LTC).

Divide your capital into 3's: $300, $300 and $300.

Buy $600 of Litecoin

If you think LTC is going to have a short-term rally, put the addition $300, or however much you have sitting on the side lines, into LTC. Remove that $300 as soon as your Stop or Target is hit.

IF you see a short-term dip coming, sell 1/2 of your LTC. In this example that would be $300 when you start out. As soon as the Stop or Target us hit, put that money back into LTC.

Using this method, you will never make a profit by shorting, but your loses will be less than if you had not sold that $300.

Here is an example:

Click image to enlarge

|