|

04/22/25 -- NEW Indicator for paid subscribers, but will post in the free newsletter also for the next 30 days: The SPY Reversal Indicator. See below.

April looks like trouble. Psychics, astrologers, remote viewers and others who peer into the future

are claiming April will be a tough month to get through. There are reports of problems in the financial

markets and violence in the geopolitical world. Joni Patry is reporting possible danger for not only Trump but

other members of his family. Checkout her recent video here: Click Here

The MVD Indicator grows more bullish as the week advances

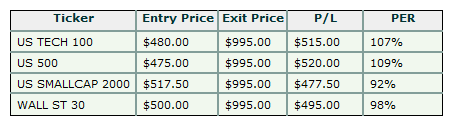

The Matrix was Bullish for Thursday, and the Confidence Indicator was also very high, so we bought Binary options on all four of the Indexes listed on Nadex.com.

|